Professional Institutional Trader Training

A HIGHER STANDARD IN PROFESSIONAL TRADING EDUCATION

Professionalism – Transparency – Commitment – Accountability

Are What We Represent

“After a second quarter of non performance and a draw down that threatened my position, we are now back to consistent profitability.”

Victor Morales – Money Manager Caymen Islands

How you the client really win: Our retail and institutional trader training is based off of a 25 year proven trading methodology incorporating Advanced Technical Analysis, that will trade on the Buy or Sell side of the Market only when specific criteria has been met. All traders in training are first taught to identify with the current state of the US Market whether short, long or market net neutral and assign a numbered level of strength based on those market conditions. Then they move into real time high probability trade set up identification, focusing on execution and then managing the trade to predetermined price profit targets. This is critical trading intelligence, as it dictates the parameters of correct contract sizing according to real time trade set ups. The net result of combining a solid daily Market call and correct high probability trade selection means higher profitability for the seasoned retail or Institutional Trader.

We trade our own money first, and educate second after the market has opened. Our primary Market is the SP 500 E-Mini Futures, with more than enough liquidity and near 24/7 opportunity to trade that provides portfolio mixing, hedging against non-correlated market instruments, or for trading on the buy or sell side for straight out speculation. This trading methodology has universal application to any freely traded market with sufficient liquidity.

Our Trading Methodology and Strategies have universal application

to any freely traded market with sufficient liquidity

WHO WE ARE & WHY SERIOUS TRADERS TRAIN WITH US

- We are a group of Professional Traders dedicated to providing the highest level of consistant trading education to Institutional and sophisticated retail traders.

- Our combined real time trading experience coupled with communicative, resourceful and capable professionals deliver over top level education with full transparency.

- Top traders, money managers and hedge fund principals exceed expectations by employing advanced technical analysis for increased profitability. We offer proven Trading Mentorship Programs, Course Material and Workshops for serious traders and students of the Market.

Higher capital allocations to prop traders like you provide the leverage for greater profits and your commissions

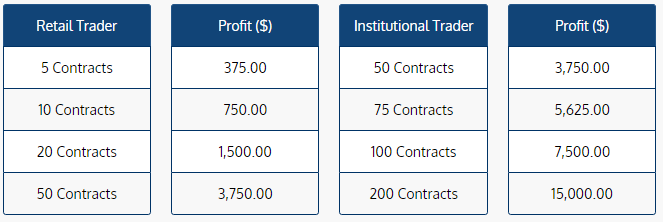

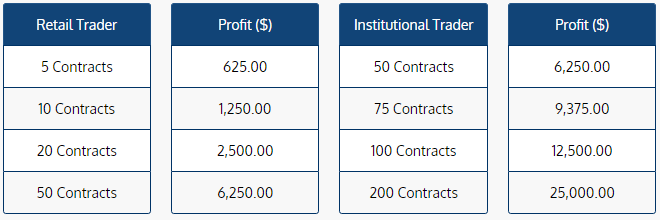

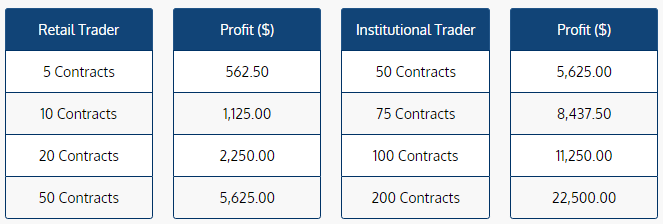

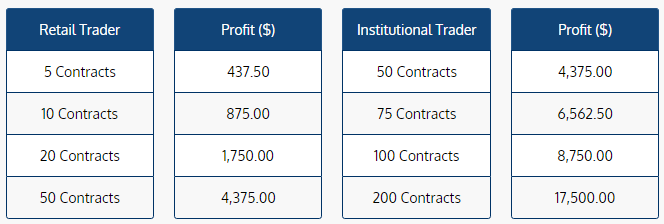

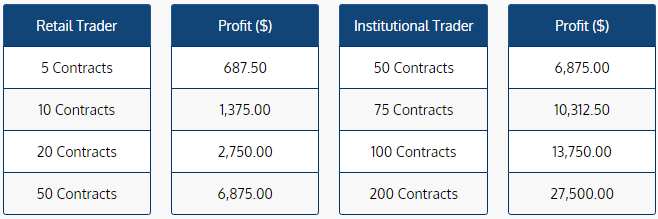

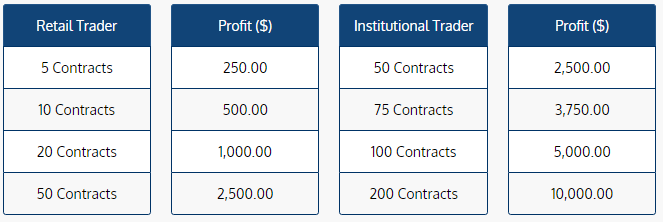

View the 10 trades below to conceptualize your categoric gains based on your relative contract sizing allocations.

All trade examples you will view were specifically executed within the S&P 500 E-Mini Futures market. However, advanced technical analysis used to qualify the daily market bias, combined with high probability real time trade setups, down to execution and trade management, are all based off of quantifying the correct supply and demand ratio of the largest market participants and trading in the same direction. This highly back tested trading methodology therefore allows the trader to trade any other free market where there is sufficient liquidity.

The first trade example has a full run time of approximately 12 minutes, and has purposefully not been edited so you see from start to finish, a model example of what the actions within the VTC represent on a daily basis. It also serves to demonstrate the type of trade selection, execution, trade management and exiting that your team will be trained to duplicate. All others have been edited solely to cut down the run time. Our methods are proprietary in nature and are held close to all VTC members. Therefore we require full disclosure from interested parties, and operate on a signed agreement basis. We are committed to one client at a time allowing both yourself and ourselves, to reach and sustain maximum proficiency and profitability.

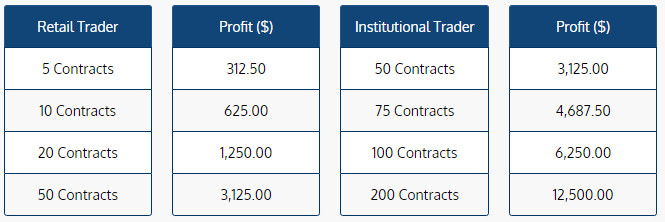

VTC WINNING TRADE: 4.50 POINTS NET GAIN / Employing Advanced Technical Analysis

SHORT TRADE: 4.50 x 50.00 USD Every full point gain/ $225.00 NET GAIN PER CONTRACT

Summary: Market had opened up on a large sell off and points spread on trades widened. This is just one example of the many trades that were taken by the Administrators of the VTC within this strong market correction. See the following contract sizing examples for high end retail and institutional trader profit categories, using advanced technical analysis.

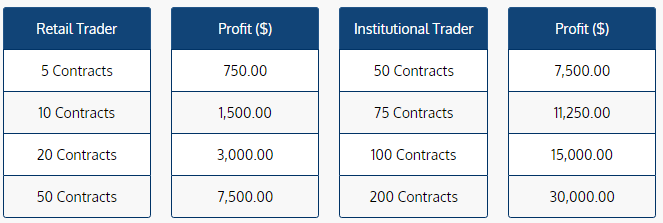

VTC WINNING TRADE: 1.50 POINTS NET GAIN

SHORT TRADE: 1.50 x 50.00 USD Every full point gain/ $75.00 NET GAIN PER CONTRACT

Summary: Market had tested support before shaking out to the upside and then moving in the anticipated direction. See the following contract sizing examples for high end retail and institutional trader profit categories.

IMPORTANT: It’s one thing to get into the Olympics, and it’s a another thing to stay in them. You know yourself it’s not just knowing what to trade, it’s knowing what to stay away from. Most traders have good idea of what set-ups to trade and when, but NOT at this level. Worse, they continue to take trades that get them stopped out only to eat into their Psychological stability. They do not understand the true mechanics inside the Market they are trading.

The (10) Trades below are real, and will provide you with more than enough proof of how we do what we do, and where you can expect to land by working with the VTC. When we say this a shared commitment at the highest level, “it is” and this is what will separate your performance from other traders. Now for 2016 all Established Retail and Institutional Traders enrolled in our Executive Mentorship Programs receive all 5 of our Custom Indicators to help you make the critical in the moment decisions to take or pass on a trade, as mentioned above. The level of Intellectual Property and the countless hours it has taken to create them, is something that is rarely ever available on the private market side.

These Testimonials were were signed off by our clients.